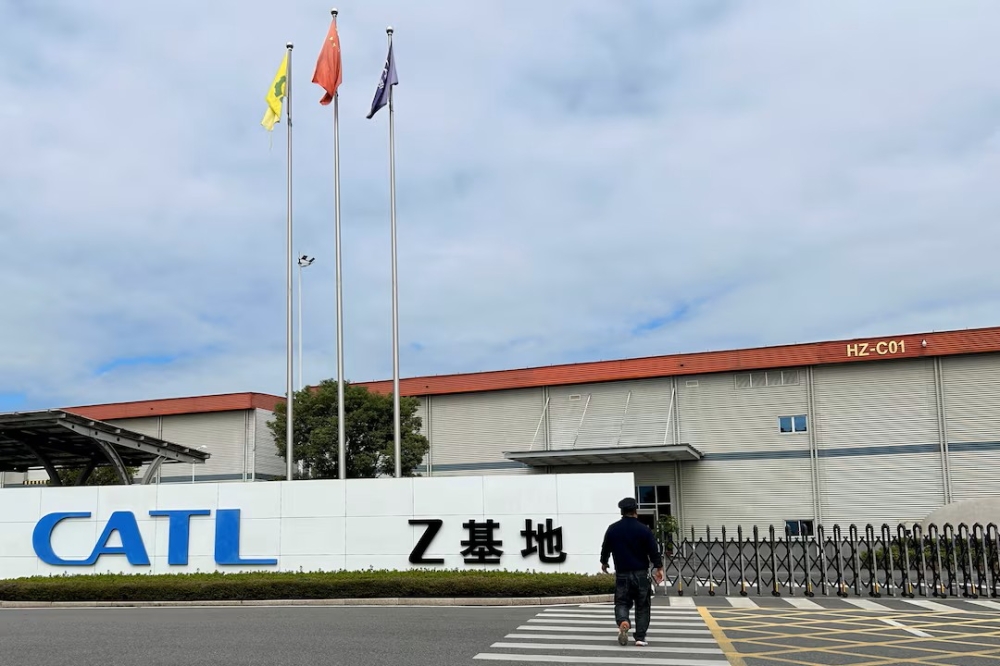

Chinese electric vehicle (EV) battery giant Contemporary Amperex Technology Co., Limited (CATL) aims to raise $4 billion through its secondary offering (IPO) in Hong Kong on May 20. This IPO is expected to be the largest in Hong Kong in 2025. CATL, one of the world’s largest EV battery manufacturers, produces more than a third of the EV batteries sold globally. The company partners with major brands such as Tesla, Mercedes-Benz, BMW, and Volkswagen.

CATL, which is already registered in Shenzhen, China, plans a secondary listing in Hong Kong. Through this IPO, the company plans to offer 117.9 million shares at a price of HK$263 (approximately $33.8 USD), aiming to raise HK$31.01 billion in total. The IPO is set to launch on May 20. The company also announced that major investors, including Sinopec and the Kuwait Investment Authority, will purchase around HK$2.62 billion worth of shares.

Founded in 2011 in Ningde, China, CATL rapidly gained success thanks to the fast-developing domestic market. However, in recent times, China’s EV market has faced weaker sales figures, and overall consumer demand has decreased, putting financial pressure on smaller companies. Despite this, CATL’s financial performance remains strong, with net profit increasing by 32.9% in the first quarter of 2025.

The company plans to use the funds raised from the IPO mainly to expand further in Europe. CATL opened its first EV battery plant in Germany in January 2023 and is currently constructing its second plant in Hungary. Additionally, in December, CATL signed an agreement with automaker Stellantis to build a $4.3 billion EV battery plant, with production expected to begin by the end of 2026.

Furthermore, analysts see CATL’s IPO as a major opportunity for Hong Kong to reclaim its status as a global IPO hub. The Hong Kong Stock Exchange has been eagerly awaiting the return of major Chinese companies after a period of reduced listings following regulatory pressures from Beijing in 2020.

However, in January, the U.S. Department of Defense included CATL in a list of "Chinese military companies," which led to a strong reaction from the U.S. government. The U.S. House of Representatives’ China Communist Party Election Committee sent a letter to U.S. banks, urging them not to participate in the IPO. Despite this, JPMorgan and Bank of America are still part of the deal.

Beijing criticized this decision as "imagined pressure" and CATL stated that it has no involvement in any military activities. To minimize legal risks in the U.S., CATL will conduct the IPO as a "Reg S" offering, meaning it will only be sold to investors outside the U.S.