The number of “operator VCs” — former startup founders turned venture capitalists — has been on the rise in Europe, following a model long popular in the United States. While many European VCs traditionally came from finance or banking backgrounds, a new wave of tech-savvy investors is emerging. Examples include Wise founder Taavet Hinrikus, Glovo founder Oscar Pierre (Yellow Fund), and Pitch founder Christian Reber.

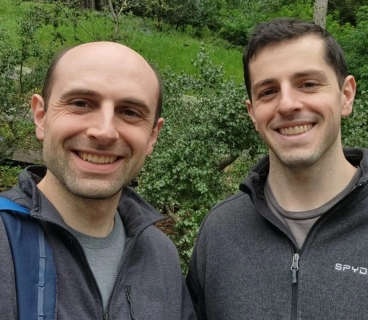

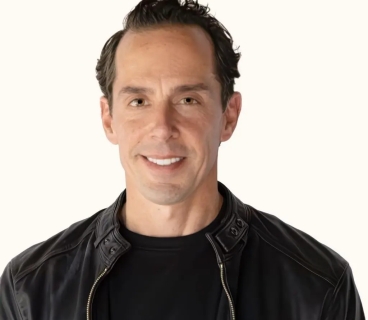

One of the newest players in this space is Ross Mason, who founded MuleSoft and sold it to Salesforce in 2018 for $6.5 billion. After the exit, Mason established Dig Ventures as a family office, eventually transitioning it into a full-fledged venture capital firm with Melissa Klinger, a former U.K. sales lead at MuleSoft and now a partner at Dig.

Dig Ventures has now closed its second fund — and its first institutional one — at $100 million. The fund focuses on pre-seed and seed-stage investments in B2B SaaS, AI, and cloud infrastructure startups, primarily in Europe, but with some interest in companies based in Israel and the U.S.

The fund is backed by limited partners such as The Hillman Company, Granite Capital, Sofina, and Grove Street. It also received support from Datadog founder Olivier Pomel and several former MuleSoft executives.

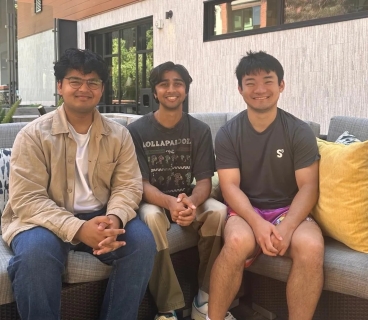

What sets Dig Ventures apart is its hands-on, founder-first approach. The team brings deep operational expertise, especially in go-to-market strategy and execution, often missing in traditional VC firms. In addition to Mason and Klinger, the team includes Rytis Vitkauskas (founder of YPlan, acquired by Time Out and former Lightspeed partner) and Scott Grimes (co-founder of Stackin’ and Uproxx, acquired by Warner Music).

The firm’s portfolio includes companies such as People.ai, Karat, Bubble, ComplyAdvantage, PlanetScale, Rasa, Taktile, Rossum, Flock, and Prophecy. Dig Ventures has already begun deploying capital from the new fund, investing in observability platform Dash0, AI orchestration platform Nexos.ai, and enterprise middleware solution PolyAPI.

“After MuleSoft, I saw a big opportunity to come back to Europe and build an operator-led fund,” Mason told TechCrunch. “And we managed to figure out a strategy where we could pick and meet founders quicker and earlier than most other funds.”

Klinger emphasized that while Dig’s sweet spot is working with deeply technical products, the firm’s ability to help startups package and sell their offerings is what sets it apart. “Going from zero to one and actually helping package that and selling it is not something any VC can do — but we can,” she said.

Mason believes the next big wave in tech will be enterprise-built AI. “It’s a new arms race, especially with LLMs being built and run within enterprises. The foundation layer isn’t done yet. A lot will become packaged open source because companies won’t want to send their data to an LLM in the cloud where they lose control.”

Klinger added that Europe has untapped potential in AI: “I think Europe’s a real dark horse in AI. We’ve got the talent at half the cost of the U.S. A lot of the brilliant research is coming out of our universities. The challenge we have is raising the amount of money that some of these AI-driven plays will need.”

As the European startup ecosystem matures and geopolitical challenges shift the global tech landscape, Europe might just be entering its era of “operator VCs.”