Trump's new trade tariffs have created significant consequences for the tech sector. As a result of this decision, Apple’s market value dropped by $250 billion, with its stock falling by 8.5%. Investments in tech companies on Wall Street have sharply declined. Alongside Apple, Tesla, Nvidia, and Meta saw a 6% drop in their stock prices, while Amazon's shares fell by 7.2%.

The tariffs, which will take effect on April 5, will see an increase of up to 54% on the tariff rate for China. Analysts at Wedbush Securities have described the move as "worse than a worst-case scenario" for tech investors. The White House has framed the tariffs as a necessary step to strengthen domestic manufacturing, with Trump calling them a move to "liberate" the U.S. economy.

The situation is particularly difficult for Apple, as the company’s supply chain and production hubs are primarily located in Asia, including China, Taiwan, India, and Vietnam. These tariffs will impact all of Apple's products, including iPhones, iPads, Macs, and other accessories.

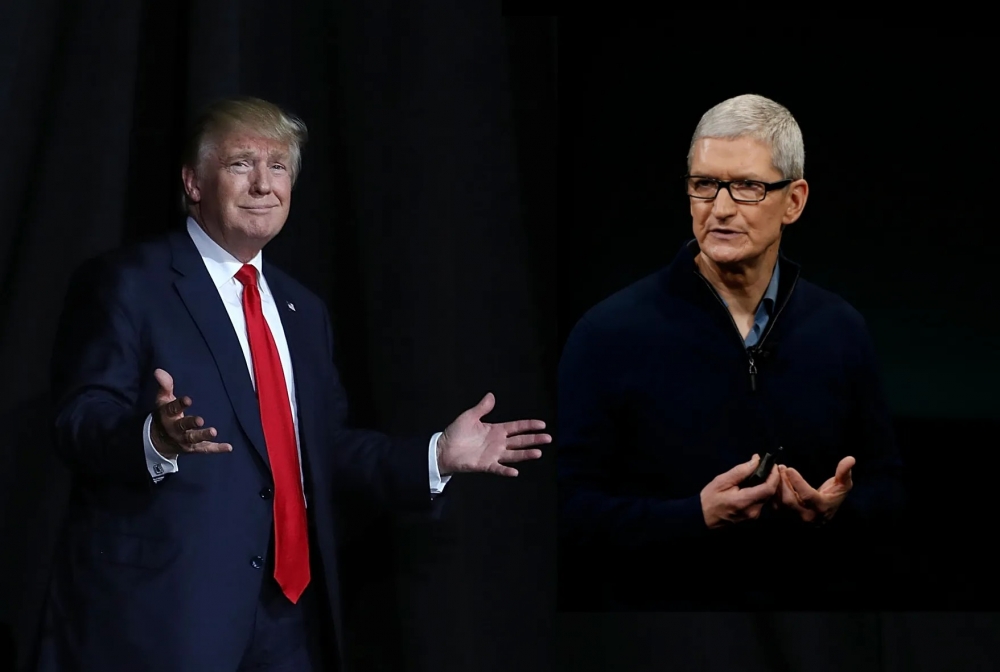

Apple’s CEO, Tim Cook, despite his efforts to build ties with the administration, has been unable to reverse the tariff decision. Now, Apple faces two choices: either raise the prices of its products and pass the burden onto consumers or absorb the losses, potentially wiping out billions in profits.